As the 2024 individual tax filing deadline approaches, 老葡京手机app is happy to share some helpful tips and strategies for tax planning. Even if it is too late to take advantage of some of these deductions and benefits for 2023 (some are still available to you!), it’s never too early to begin planning for the 2024 tax year. Please contact a 老葡京手机app tax professional or financial planner to ensure you are taking advantage of as many benefits as possible.

Contribute to Your Retirement Plans

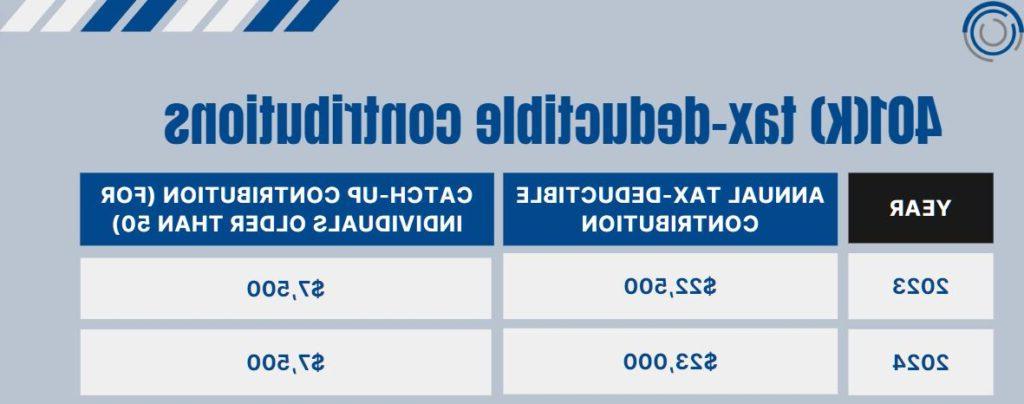

Retirement accounts are one of the easiest ways to lower your tax liability. Contributions to retirement accounts including 401(k)s or other employer retirement plans, IRAs, and similar plans are often tax-deductible in the year of contribution and grow tax-deferred. Contributions to Roth accounts, such as Roth 401(k)s or Roth IRAs, are made with after-tax funds and withdrawals are generally tax-free. Your investments have the benefit of compounding growth without immediate tax consequences. One example is the annual contribution limits to a 401(k), which are detailed below.

Contributions for 2023 to your traditional IRA or Roth IRA may be made until the due date or filing date of your 2023 tax returns, if eligible. IRA contribution limits are $6,500 for 2023 and $7,000 for 2024, with catch up contributions of $1,000 in both years for those 50 and older.

Several plans are also available for solo or small business owners, such as solo 401(k)s, SEP IRAs, SIMPLE IRAs, etc. Please consult a tax professional for more information on eligibility rules and contribution limits.

Health Savings Accounts

Contributions to health savings accounts (HSAs) are tax-deductible and withdrawals used for qualified medical expenses are tax-free. For 2023, individuals can deduct up to $3,850 from their taxes while family HSA plans have a deductible limit of $7,750. Individuals 55 and older are eligible to make an additional $1,000 contribution. While it may seem confusing to read about 2023 contribution limits, the good news is that contributions can be made for the year 2023 until April 15, 2024. So, you still have time to make contributions for last year. The even better news is that contribution limits for 2024 have increased to $4,150 for individuals and $8,300 for family plans.

Tax Loss Harvesting

Selling your market investments at a loss may seem unwise but it offers one key advantage: offsetting tax gains. A declining market lets investors sell stocks or bonds at a loss and use the capital loss for their current or future taxes. These losses can be applied to gains from the sale of other stocks, bonds or other investments, homes and businesses. While they can be carried forward indefinitely, harvested losses can only be used to offset up to $3,000 of ordinary income. This strategy includes several complicated risks and rules, so it is important to talk to your tax advisor before making a move.

Maximize Charitable Giving Tax Opportunities

Donating to a cause you believe in is a generous act which can also lighten your tax load. Cash and in-kind donations represent one deduction but qualified charitable distributions (QCD) available through some IRA accounts (assuming you are at least 70½ years old) can also reduce your taxable income. QCDs may also fulfill your required minimum distribution (RMD), if you have one, meaning this portion of your RMD is tax-free. The maximum amount that could qualify for a QCD is $100,000.

Another charitable option available for investors is the donation of appreciated securities. These stocks, bonds or other investments can be donated to organizations without facing a capital gains tax, qualifying you to write off their full worth without penalty.

Another commonly used vehicle for charitable giving are donor-advised funds, or DAFs. DAFs allow you to bunch several years of annual donations at once and receive a deduction for the full amount in the year contributed to a DAF. Then, those funds can be distributed to your designated charities each year. DAF contributions are useful in years where income is very high so you can offset some of that income with the amount of the DAF deduction.

Give Tax-Free Gifts to Family

Taking advantage of the annual gift tax exclusion lets you transfer wealth to family members without incurring gift taxes. Individuals could gift loved ones up to $17,000 in 2023 (with an increase to $18,000 in 2024) without facing a gift tax filing. Gifting can be a powerful tool for estate planning and reducing your taxable estate. Consult with a financial advisor to explore the best gifting and wealth transfer strategies for your situation.

Use the Home Office Tax Deduction

Working from home is a popular choice for some workers and carries the possibility of a tax benefit. One deduction lets self-employed taxpayers working from home write off expenses attributed to their home office. The office must be a defined area of the house used solely and regularly for business purposes. If your office qualifies, a portion of your utilities, mortgage interest and other home-related expenses may be deducted as business expenses. Of course, with so many individuals working from home these days, it is worth noting that not everyone is eligible for this deduction. Regular workers working from home are not eligible for this deduction as the current tax law stands.

Other Tax-Efficient Investments

Below are a few other investment opportunities to consider now and in the future.

- Index funds and exchange-traded funds (ETFs) have lower levels of taxable capital gains than actively managed mutual funds because they have lower turnover in their holdings. They also often have lower fees.

- Municipal bonds, which often fund public projects, enjoy a special benefit when it comes to interest income, which is exempt from federal taxes. Assuming the investor resides in the municipality where the bond issued, no state or local taxes will be assessed either.

- 529 college savings plans financially support your children’s educational goals. The growth of your investments and qualifying withdrawals are tax free, which makes for a great long-term benefit. While contributions to these plans do not qualify for a federal tax deduction, some states offer contribution deductions.

We realize that with the tax deadline quickly approaching, you may not have time to take full advantage of the opportunities available to you for the 2023 tax year. But as we mentioned at the beginning of this article, it is never too soon to begin planning for the year ahead. Our tax accountants and financial planners are ready to assist.

Councilor, Buchanan & Mitchell (老葡京手机app) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.